In the official MyMilestoneCard login, Milestone is an insecure credit card that gives users the ability to increase their credibility. People can generally start with a credit limit of $ 300 per card, but the brand will set your credit limit based on your current profile once it is approved.

Once approved on the MyMilestoneCard link, the card offers many legitimate standards and benefits that you can find on secure cards from reputable organizations.

MyMilestoneCard Login

or

Get Help!

The MyMilestoneCard connection provides all registered cardholders with services that have been officially issued by the Missouri Financial Organization in partnership with the Genesis FS card organizations. Milestone cardholders can access their account details online as they have a secure online account service center for relevant transactions.

Step By Step Registration Process For New Users

You must purchase www.mymilestonecard.com to enroll in the MyMilestoneCard in order to log into MyMilestoneCard. If you are not familiar with all check-in procedures or are looking for the step-by-step check-in process to log into your MyMilestoneCard, then you have come to the right place.

- First of all, you need to open your computer or any other smart device like laptop, smartphone, tablet, etc. to access the Internet connection.

- Then you need to connect your device to internet access.

- Now you need to open the web browser on your computer or smart device and go to the home page of the official website mymilestonecard.com.

- After visiting the home page of their official website, on this page, you will see the blue registration button available in the upper right corner of the page.

- Then just click on the Register button.

- After clicking, you will be directed to the MyMilestoneCard registration page.

- On this page you will see three columns, the first is the “Account Number” column, the second is the “Date of Birth” column, and the third and last column is the “Social Security Number” column.

- You must complete all specified columns with the appropriate information based on the columns.

- After that, just click the Next button.

- After clicking, you can register my practice card successfully.

Login Process Steps For Registered Users

- First of all, you need to open your computer or any other smart device like laptop, smartphone, tablet, etc. to access the Internet connection.

- Then you need to connect your device to internet access.

- Now you need to open the web browser on your computer or smart device and go to the home page of the official website mymilestonecard.com.

- On this page you will see two columns, the first is the Username column and the second is the Password column.

- After that, you need to fill in the Username and Password columns with the appropriate information according to the columns.

- Now simply click on the blue login button that appears to successfully log into MyMilestoneCard.

With so many credit cards to choose from, you must choose a card that offers real benefits wherever you are. Enter Milestone God MasterCard, your only real friend in shopping and investing. Applying for a card prequalification slightly lowers your credit score. Milestone Gold MasterCard may be the perfect card for those who want to apply without worrying about losing credit. Milestone credit cards can be used even if your credit score is relatively low. With the additional benefits of the card, buyers can also benefit and improve their creditworthiness.

Information About The Login Portal

The Milestone card, also classified as Milestone Gold Mastercard, is a credit card issued by the Bank of Missouri. In addition to the Official Bank of Missouri, Genesis Financial Solutions is also responsible for issuing the MyMilestoneCard.

Established as Bank of Perryville, Bank of Missouri was the only bank in Perry County, Missouri, USA, to be renamed Bank of Missouri in 1997, expanding its business and services to other banks. Currently, the bank has more than 20 branches in various locations.

Genesis Financial Solutions is officially a customer-centric financial services company. The company is committed to helping people with low credit scores grow their credit profiles and earn scores dramatically. Genesis FS is a leading financial services company in the United States and continues to offer the best possible options and services.

The official Milestone Gold Mastercard is remarkably linked to the top three rating companies and gives cardholders the ability to have a regular cost history when spending with a credit card. As a newcomer to leadership, you should set milestones for the task at hand using the following three questions.

What Is The Milestone Credit Card Activation?

Milestone credit card activation is a process that prepares the card for purchases. If you have just received your credit card, you will need to activate it to make purchases or use it. If the card arrives in the mail, it is not ready to use yet. You have to turn it on and put on a pen.

Activation may seem like a huge hurdle to some. However, we make the process easy with a simple guide. Read and have fun with the Milestone credit card.

If you’re low on credit, the Milestone Gold MasterCard is for you. The purpose of the card is to help you build your balance and qualify for the best cards in the future. The card is a product of the Bank of Missouri, based in Dixon Missouri. The bank is certainly legitimate due to its FDIC insurance.

Milestone Gold MasterCard is definitely one of the best high-risk credit cards you will find on the market. Don’t be fooled by the low credit limit and high annual fees. This card will be offered at a reduced price compared to cards from other financial institutions in April.

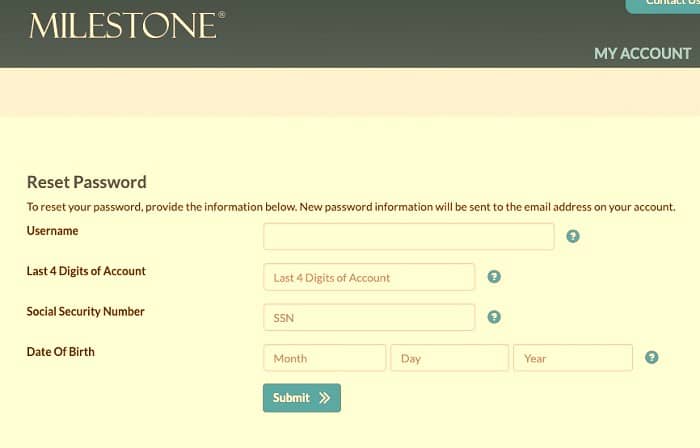

Know Card Activation Process

If you have not activated your Milestone Gold MasterCard, you can do so directly on the website (milestone.myfinanceservice.com). You will need to enter information such as your bank account number, date of birth, and social security number.

Then click “Next” and follow the instructions until the end of the process. You will need to create a username and password to use and manage your card online.

| Official Name | MyMilestoneCard |

|---|---|

| Benefits | Credit Score, Online Payment |

| Eligibility | 18 years or Above |

| Services | Gold Mastercard |

| Authorized Bank | The Bank of Missouri |

Check Official Features Of The Login Portal

True to their official name on MyMilestoneCard.com, all credit cards provide cardholders with gold benefits. Some of the benefits associated with connecting MyMilestoneCard are mentioned here for the benefit of cardholders and readers.

- Quickly available to affected cardholders.

- No effect on credits or grades.

- Choose your favorite card design.

- The company uses smart card technology.

- Cardholders have free access to an online account.

- There is no deposit. No responsibility.

- All you have to do is register, register, and log in.

- Pay all your bills online by direct debit or direct debit.

- Dematerialization of banking operations and bank statements.

- Account information is updated at any time.

- Build a decent and legitimate credit score.

Make a relevant purchase with MyMilestoneCard or receive a refund if MasterCard is accepted. Cardholders can easily access them in 201 countries.

Why Credit Scores Are Important?

My passcards are actually safe cards for people with bad credit. If a person is in an emergency or wants to change their credit card, it is better to buy a new credit card to improve their credit score.

This card is not ideal like any other relevant credit card, as it also has annual fees, transaction fees, and penalties for online payments. The only good thing about this card is that it has a low APR without a good credit rating for cardholders.

Required MyMilestoneCard:

- Milestone MasterCard Gold.

- Milestone MasterCard.

- Milestone Mastercard (mobile access).

- Milestone Mastercard with free choice.

Eligibility Criteria To Login The Official Portal

Everyone dreams of getting a MyMilestoneCard and it is easy to apply online at www.mymilestonecard.com. As a well-known and one of the most famous credit card companies, you must meet all the necessary criteria to apply for the MyMilestoneCard. The eligibility criteria for this card are as follows.

- Applicant must be 18 years old to apply for this card.

- The person applying for this card must have their own permanent address, a bank account, a US ID, and a social security number.

- The individual must meet all business income requirements as well as examination guidelines.

- The applicant cannot have another credit card account at another bank.

- The applicant must follow all directives and instructions required by the bank.

Frequently Asked Questions

How Do I Activate MyMilestoneCard?

Activate your card by registering at www.mymilestonecard.com and following the instructions. Once activated, you can use your card immediately for purchases and cash advances.

Does The Milestone Credit Card Have An Application?

You can access your Milestone Mastercard account through The Bank of Missouri mobile app, available for iOS and Android.

How Can I Contact A Milestone Credit Card?

While we provide customer service at 1-866-453-2636 (6 a.m. to 6 p.m. Pacific time, seven days a week), we currently do not offer a phone app option. Click here to rate online.

What Are The Privileges Of MyMilestoneCard?

Milestone Gold MasterCard is clearly one of the best high-risk credit cards that you will find among the alternatives to the MyMilestoneCard login services. Cardholders should not be fooled by the card’s low credit limit and high annual fee, as this credit card has a low APR compared to other cards during the same hours.

Thanks to the perfect use of modern technology, everyone prefers the Milestone Card online services and it has even made payment a lot easier for customers.

- If the cardholder requests a duplicate of MyMilestoneCard credentials, no additional costs will be charged.

- The latest online payment deadline is 5:00 p.m.

- If customers have relevant questions about their registered accounts, they can contact customer service directly at 1-888-260-4532.

- Access your account details 24 hours a day with very little effort and access your saved login details.

- Cardholders can even request paperless statements on the myMilestoneCard login portal.

Where Can I Use My Milestone Gold MasterCard?

Like any card or credit card, you can use your Milestone Gold MasterCard to pay in-store and online. At a physical store, you will need to swipe or insert your card depending on whether you have a magnetic stripe or chip and PIN problem. When making your payments online, all you need to do is log into your account.

You can then authorize payments from your credit card balance. You can also use your credit card to pay your bills. Automated payments are ideal for bills that repeat every month. In fact, they make sure you don’t forget about past due bills.

What to Do if Your Milestone Gold MasterCard is Lost or Stolen?

If your card is lost or stolen, a thief can use it to withdraw your hard-earned money. Therefore, it is important that you take the correct steps to ensure that you are protecting yourself. You should immediately report your lost or stolen card to 1-888-260-4532. You don’t want to be responsible for charges for payments made with your lost or stolen cards.

About

Official MyMilestoneCard.com is the only platform that takes full advantage of it. In fact, the retirement card account is much easier for new and existing customers to access. A low credit limit on this card can improve the cardholder’s job to reduce credit usage on that credit card, and sometimes even more.

Milestone Legitimate Credit Card Login Portal helps all cardholders, including newbies, to access the portal. There are on-screen instructions for customers to become successful cardholders. There are also official guidelines for readers to understand the brand’s purpose behind providing the credit card with official rules and regulations.